32+ bank statement mortgage lenders

These are essentially hard money loans. Ad Use Our Comparison Site Find Out How to Get Pre Approved for Mortgage.

Bank Statement Loans Self Employed Mortgage Refinance Griffin Funding No Change

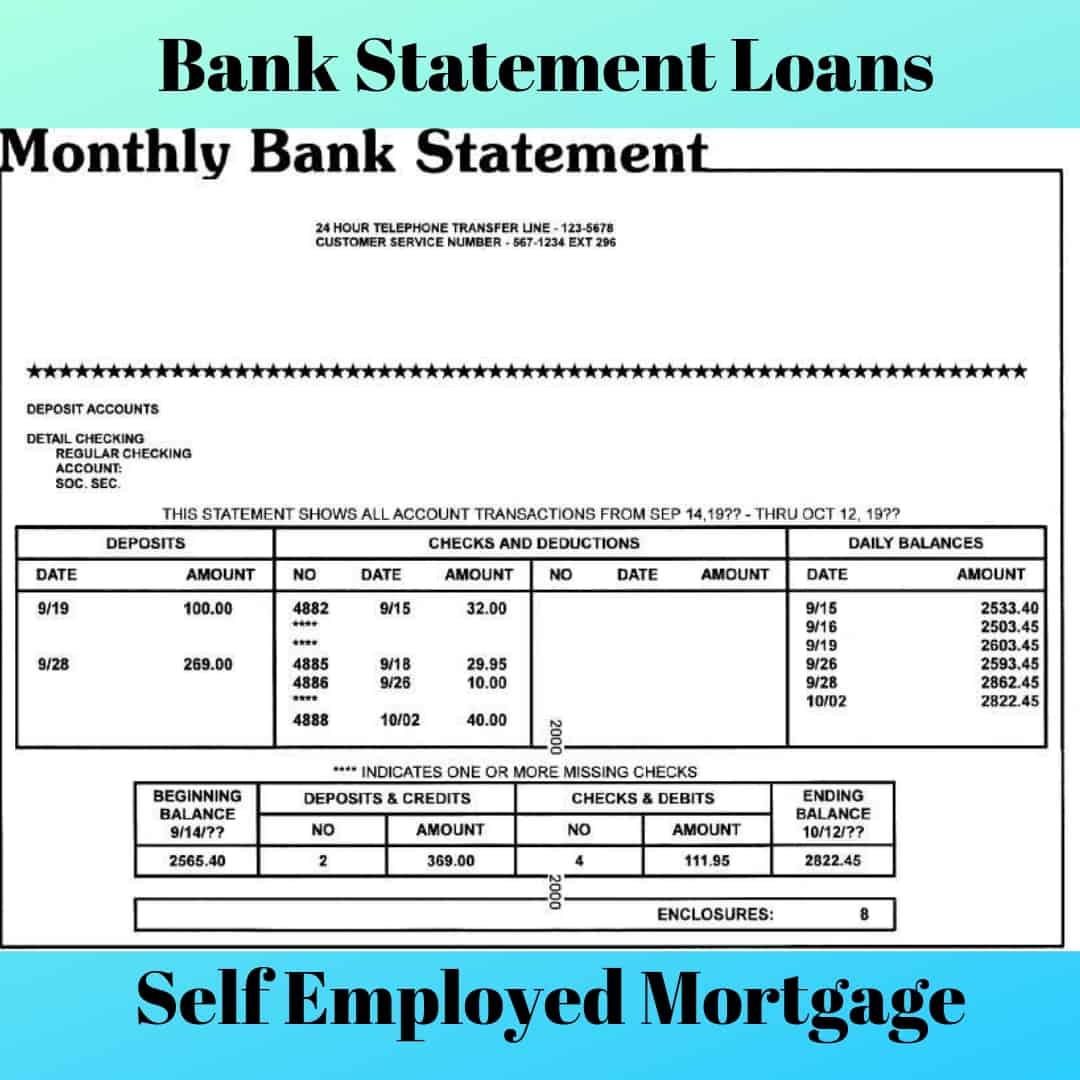

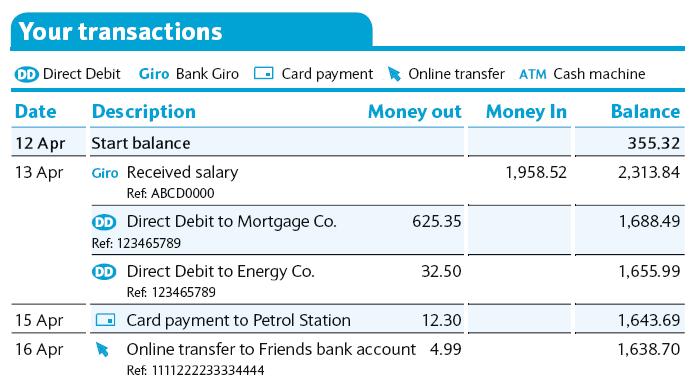

Web Bank Statement As stated earlier lenders will ask you to provide bank statements of the past 12 to 24 months.

. Web The rules for these loans apply to loans of 250000 or less. Web Mortgage lenders require bank statements from their borrowers during the application process to verify income assets and their overall eligibility for a loan. 12 24 months of bank statements showing deposits.

Home loan solution for self-employed borrowers using bank statements. Ad Compare the Top Mortgage Lenders Find What Suits You the Best. Get Instantly Matched With Your Ideal Mortgage Lender.

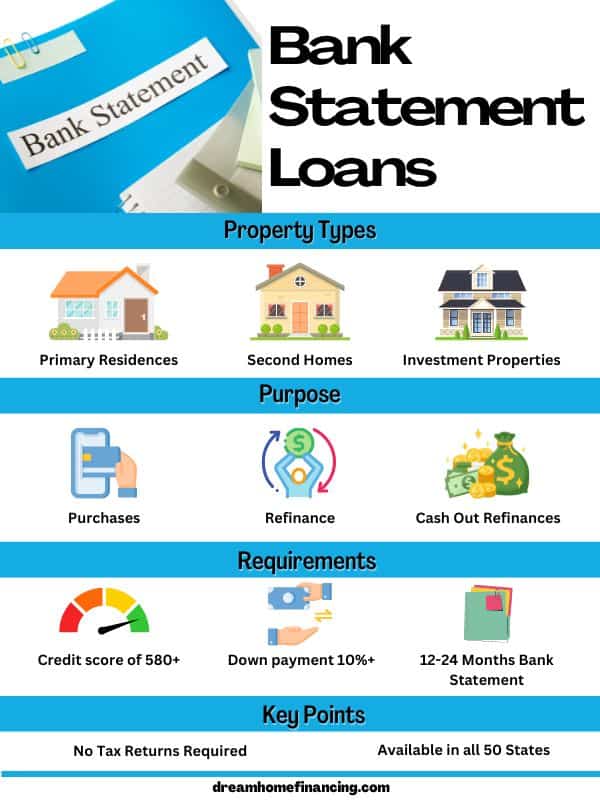

Web But here are some standard requirements youll have to meet to secure a bank statement mortgage loan. Web A bank statement mortgage allows eligible self-employed borrowers to use bank statements to help verify income instead of tax returns. Web The lender needs to verify that the funds required for the home purchase have been accumulated in a bank account and accessible to the lender.

Loan amount up to 3 million. Choose Smart Apply Easily. Ad Mortgage loans without tax returns or paystubs for self-employed borrowers.

No tax returns required for self employed. Best Mortgage In California. Check How Much Home Loan You Can Afford.

102633 Requirements for reverse mortgages. Keep in mind that applicants who can provide 24 months of. Web Qualify for a mortgage through your bank statements.

No Tax Returns or W2s are Needed. See Volume 3 issue 1 for a discussion on hard money loans. There are other ways a.

Web Down Payment. Special Offers Just a Click Away. A proof of deposit.

Ad 10 Best House Loan Lenders Compared Reviewed. Ad Compare Home Financing Options Get Quotes. You might be able to make us of both business.

Web While most lenders require a minimum of 12 months of bank statements some may require less. FDIC Insured Online Banks Are A Great Place To Save And Offer Convenient Features. No tax returns required.

Ad Mortgage loans without tax returns or paystubs for self-employed borrowers. NMLS 330511 Minimum credit score 620 Mortgage rates Lower than the national average. Ad Out-Earn Brick-And-Mortar Banks With Online Savings Accounts Without Visiting A Branch.

Web Each bank statement loan lender is listed next to its Better Business Bureau BBB rating which run from F to A. Loan amounts from 150000 to 3 million. Web Get a mortgage you can rave about.

Web 102632 Requirements for high-cost mortgages. Union Home Mortgage Corp. Comparisons Trusted by 55000000.

A lender will use these. Home loan solution for self-employed borrowers using bank statements. 800-767-4684 NMLS 2229 NMLS Consumer Access website.

102634 Prohibited acts or practices in connection with high-cost. Web Lenders require 2 months actual bank statements digital or paper copies for each account on the application and for any assets we need to source for other. Since the bank statement loan program falls under Non-QM loans mortgage lenders typically require a higher down payment of around 10 to 20.

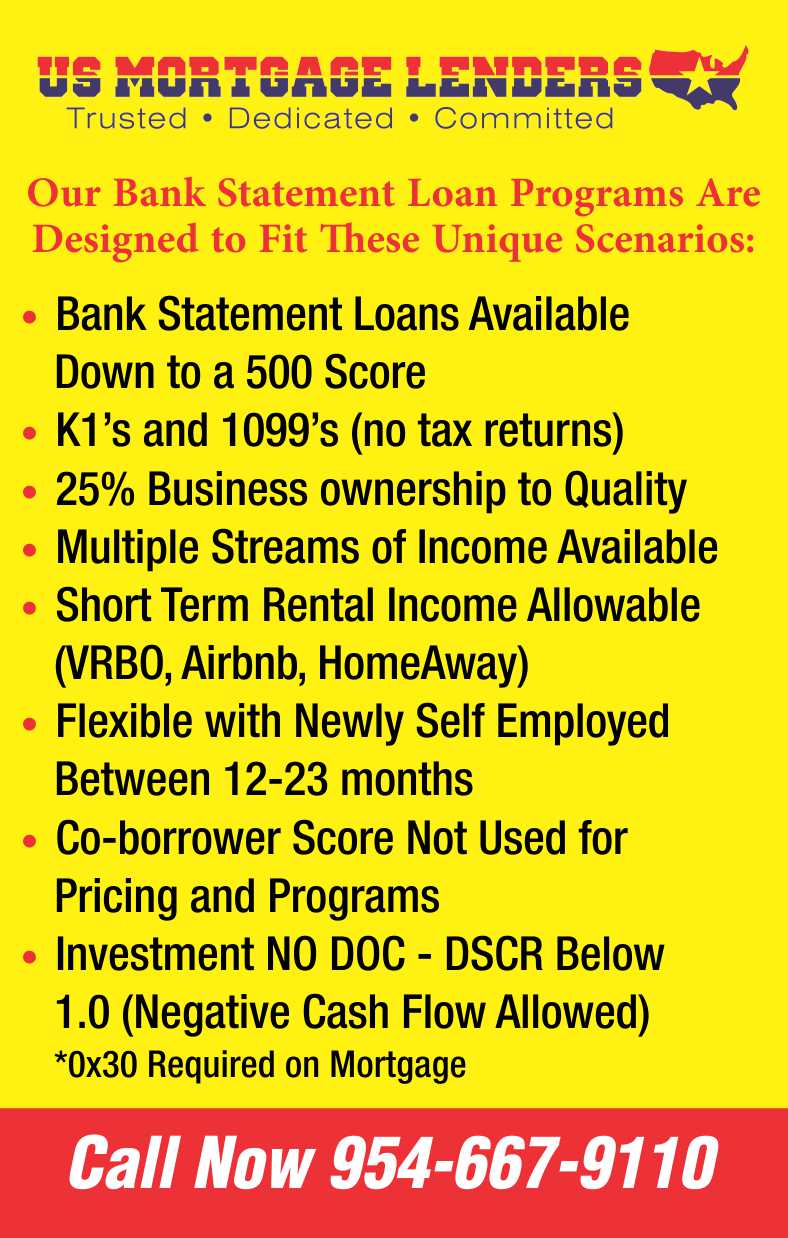

Qualified based on Personal or business statements for the most recent 12 months. Web Bank statement lenders offer programs with the following potential advantages. Lock Your Rate Today.

Web Types of Loans Excluded from Section 32 Purchase-money loans home equity lines of credit and loans on non-owner occupied dwellings are not subject to Section 32. Credit scores as low as 500 accepted. Less Paperwork and Hassles.

Use this loan to. Web A lender has to submit a POD proof of deposit form to a bank to receive the confirmation of the loan applicants financial information. Loan amounts available up to 5000000.

Compare Best Lenders Apply Easily Save. Ad We Use Bank Statement to Qualify. Web Finally your lender uses your bank statements to see whether you have enough money in your account to cover closing costs.

Web A bank statement is a document that shows your financial transactions and banking activity. Closing costs typically range. Purchase Refi Options.

It can guide you as an account holder in tracking your finances finding.

Bank Statement Only Mortgage Lenders Questions Answers

12 Month Bank Statement Mortgage For Self Employed Borrowers

Bank Statement Loans For Self Employed 2022 Bank Statement Lenders

Escrow Account Information We All Can Benefit From Knowing

Bank Statement Loans For Self Employed 2022 Bank Statement Lenders

Three Types Of Bank Statement Loans Homexpress Mortgage

Helen Moore Mortgage Broker In Subiaco Mortgage Choice

Bank Statement Mortgages For Self Employed Borrowers Moneytips

Bank Statement Loans For Self Employed 2022 Bank Statement Lenders

Modern Mortgage History

Self Employed Home Loans Home Loans Bank Statement Loans For Self Employed 214 945 1066 Youtube

Bank Statements For Mortgage Applications Niche Mortgage Broker

Bank Statement Loans Mortgage Lenders And Requirements

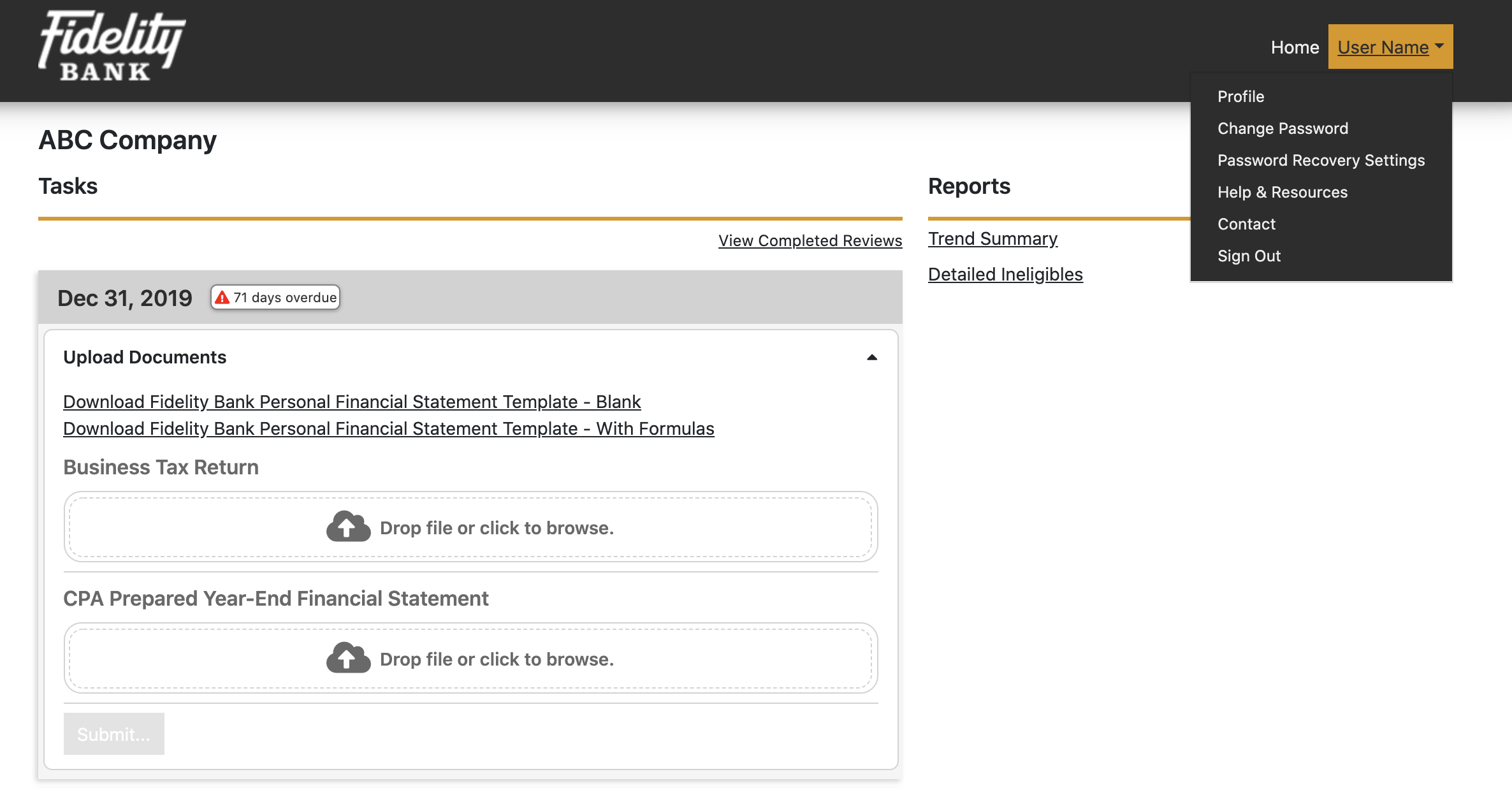

Business Solutions Fidelity Bank

Vital Aspects Of Your Credit Health Valley West Mortgage

Bank Statement Loans Mortgage Lenders And Requirements

Bank Statement Mortgage Loans Bank Statement Loans Rates